October 14, 2025

Basic policy on corporate governance

The Kyorin Group will work to improve sustainable corporate value to gain the confidence and meet to the expectations of all stakeholders. As part of these efforts, the Group considers strengthening and enhancing corporate governance an important management issue.

The most important management goal for the Company is to continue raising shareholder value. To achieve this goal requires fostering a management environment that enables us to build trust with the general public. Therefore, having given better corporate governance a high priority, we seek to ensure prompt decision making, strong monitoring of the appropriateness of management, and ethical and transparent corporate activities. To ensure transparency and fair disclosure, we release appropriate information without delay for the benefit of shareholders and investors. In the future, we intend to actively increase our disclosure of information, and expand our communications with all stakeholders.

The Company has appointed three outside directors to further strengthen the supervision of the business execution of directors and to further enhance the transparency and fairness of management.

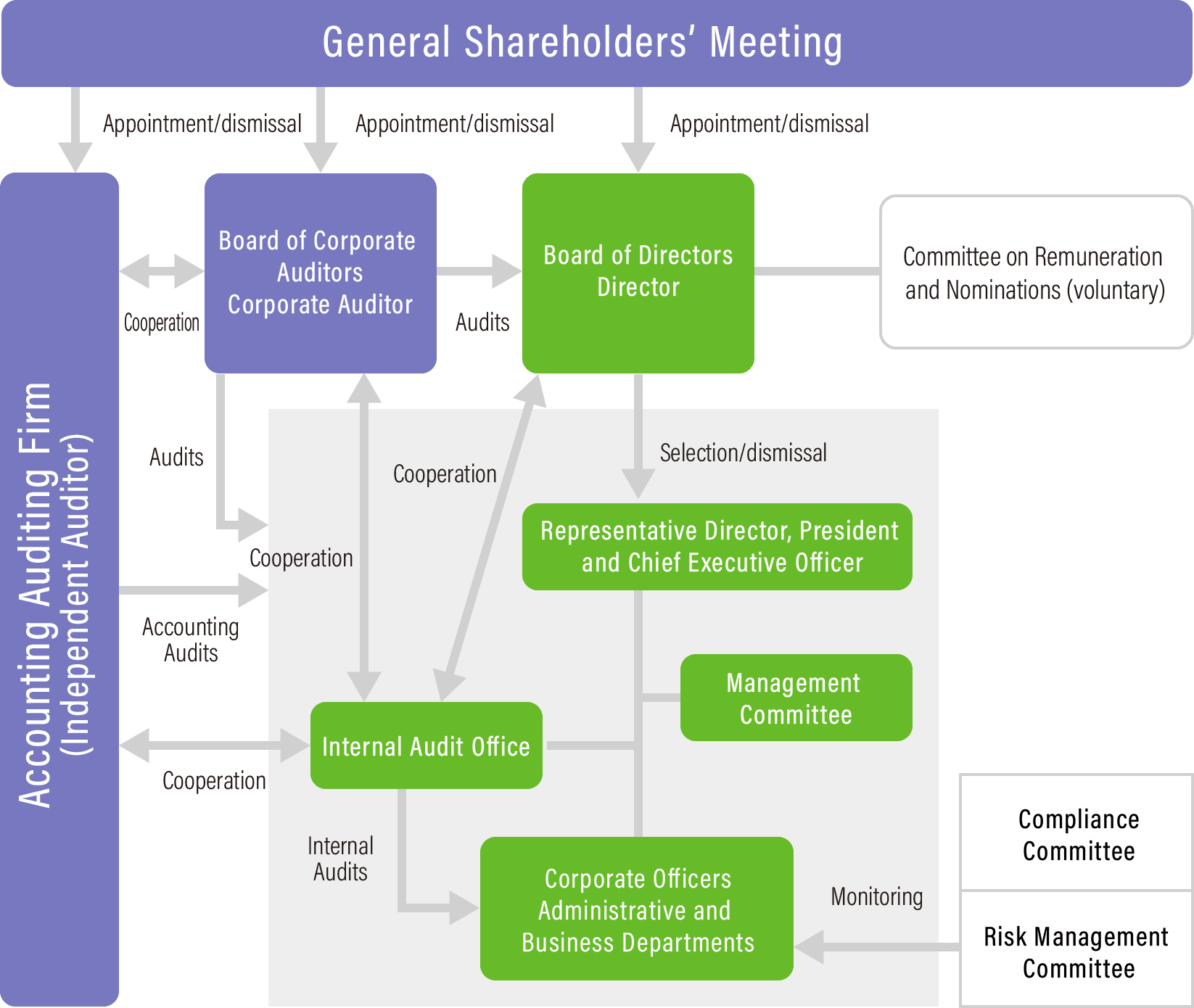

The Company is a company with a board of corporate auditors based on the Companies Act of Japan. The Board of Corporate Auditors, including three outside corporate auditors, endeavors to fully demonstrate its auditing and supervising functions and to ensure the transparency of the decisions made by the Board of Directors. At the same time, corporate auditors carry out a diverse range of activities to fulfill their auditing function. In addition to participating in important meetings, including those of the Board of Directors and the Management Committee, corporate auditors implement comprehensive audits by checking documents and other materials relating to important decisions and inspecting Group companies.

In addition, in recognition of our corporate social responsibility (CSR), we appoint compliance and risk management promotion officers for each department at each Kyorin Group company. We have established a Groupwide compliance and risk management system administered by the Compliance Committee and Risk Management Committee. We have decided guidelines for each Group company and set up a system for employees to report possible irregularities and seek advice. As well as the above measures, we have created management guidelines for affiliated companies and built a system of governance while securing their autonomy. Under this system, we receive regular business reports from these companies and meet with their management before deciding important issues.

The Internal Audit Office conducts audits of each Group companies based on internal audit guidelines. Following the results of these audits, the heads of departments that oversee the operations of the Group companies issue instructions or warnings and provide appropriate guidance.

Management Organization and Internal Control System

1. Management Organization

The Company is a company with a board of corporate auditors based on the Companies Act of Japan, and Board of Directors, Board of Corporate Auditors, etc.

To clarify the roles of our directors, who are responsible for making business decisions and supervising business execution, and corporate officers, who are responsible for business execution, we have established a corporate officer system. The Board of Directors usually meets once a month, deciding important operational matters in a timely manner after debating issues as well as supervising each director’s duties. To oversee business execution, we established a Management Committee, comprising the president and directors, which discusses key operational matters concerning the Group. In addition, at its Ordinary General Shareholders’ Meeting, We appointed three outside directors, and we will be leveraging their independence, rich experience, and high level of specialization to further enhance our management transparency and monitoring functions.

The Company’s Board of Corporate Auditors comprises two statutory corporate auditors and three outside corporate auditors. By capitalizing on such auditing and supervisory functions, we have built a system that facilitates highly transparent decision-making.

Corporate Governance and Management Structure

2. Internal Control System and Risk Management System

We are building an internal control system in accordance with the following basic policy.

Basic policy

In keeping with our corporate philosophy of "cherish life and benefit society by contributing to better health," we undertake our activities in Japan and overseas guided by a high standard of corporate ethics as we respect human rights and comply with the letter and spirit of all laws and codes of conduct.

- (1)We established the Compliance Committee, which is chaired by a corporate officer in charge, and controlled by “Promotion Compliance & External Relations” department and includes the participation of the Director of the Internal Audit Office who serves as a member of the committee. Thoroughgoing guidance is provided to executives and regular employees via training programs, while the Corporate Ethics Hotline has been set up for consultations and reporting matters concerning internal violations. Moreover, we have set Company rules to ensure the accuracy of financial reporting, and developed systems for ensuring the validity and reliability of internal controls over financial reporting of the Group.

- (2)We are building and operating a structure for reducing and preventing risks. As part of this structure, we established the Risk Management Committee, chaired by a corporate officer in charge, with the General Affairs Department responsible for overseeing the committee. For risks concerning compliance, the environment and accidents, we also formulated the Risk Management Guidelines and the Corporate Ethics and Compliance Guidelines as part of a quick-response structure. Additionally, to handle crisis management when dealing with any contingencies, we have set up the Contingency Measures Headquarters under the leadership of the president.

- (3)In accordance with the Documentation Management Guidelines and other internal regulations, we carry out the appropriate preparation, preservation and management of information regarding directors' decisions, their execution of other duties and reports concerning directors.

- (4)To ensure that audits are conducted effectively, the Company’s accounting auditing firm explains the content of the accounting audits to the corporate auditors, exchanges information with them, and also cooperates with the audit divisions to ensure appropriate communication and effective performance of audits.

- (5)Along with establishing compliance committees and risk management committees at each Kyorin Group company, the Compliance Committee and Risk Management Committee. oversee and promote compliance and risk management for the entire Group. In addition, we have built a structure for consultation and reporting that covers the whole Group.

We will create management guidelines for affiliated companies and build a system of support that respects their autonomy. Under this system, we will receive regular business reports from these companies and hold meetings with their management before deciding important issues.

The Internal Audit Office performs audits of affiliated companies based on internal audit guidelines. Depending on the results of these audits, departments that oversee the operations of the affiliated companies issue instructions or recommendations and provide appropriate guidance. Moreover, we are also building a structure that enables managers to prepare reliable internal control reports for financial reporting. Under this structure, the Internal Audit Office also evaluates and reports on internal controls related to financial reporting based on the Standards and Practice Standards for Management Assessment and Audit Concerning Internal Control Over Financial Reporting.

3. Basic rationale on the elimination of anti-social forces and the establishment of related measures

Giving consideration to our corporate philosophy, we formulated the Kyorin Corporate Charter to ensure a high standard of corporate ethics and thoroughgoing compliance. This charter clearly states that we will "stand firmly against any anti-social forces or groups that pose a threat to the order and safety of society", and we strongly confront anti-social forces or groups.

We have also established standard measures to prepare for any possible undue demands from anti-social forces. To this end, we have built a structure that includes designating a “person responsible for prevention of undue claims” at our Head Office and all branch offices of each Group company to respond to encounters with any anti-social forces or groups. We also maintain close communications with police authorities and legal advisers to ascertain the latest trends and gather other information on anti-social forces or groups as well as for guidance, consultation and assistance. Also, we have prepared Responding to Telephone Calls and Visits to the Company During the Initial Phase of Claim-related Problems as a manual, to ensure that employees make appropriate initial responses. In this manner, we have established a structure for properly responding to any demands from anti-social groups.

4. Audit Organization

(a)Corporate auditors

Corporate auditors conduct audits in line with an auditing policy and plan set by the Board of Corporate Auditors at the beginning of each fiscal year. In addition to participating in important meetings, including those of the Board of Directors and the Management Committee, corporate auditors implement comprehensive audits by checking documents and other materials relating to important decisions and by inspecting each departments, facilities, office, and Group company.

(b)Initiatives to strengthen the function of outside corporate auditors

Three outside corporate auditors are neutrally positioned and uncompromised by relationships with management or parties with special interests. All have considerable knowledge about corporate legal affairs, finance or accounting. We leverage their specialist perspectives and wide-ranging insight and experience to enhance and strengthen our auditing function.

Under our adopted system, if executives or regular employees discover that an executive officer or employee is acting in contravention of laws and regulations, or the Company’s Articles of Incorporation, they immediately notify the corporate auditors. We are working to establish an environment conducive to more efficient audits by corporate auditors by coordinating closely with executives and regular employees and by fostering deeper understanding of audits.

(c)Internal auditors

Internal audits are conducted by the Internal Audit Office, which is staffed by seven employees who report directly to the president, and is independent from other sections. Following yearly auditing plans, the Internal Audit Office regularly assesses and evaluates the effectiveness and efficiency of the legal compliance and internal control systems in the Company and Group companies. After an audit, the office communicates any problems or areas that need improvement directly to the president and makes appropriate recommendations.

Another function of the office is to evaluate the Kyorin Group’s internal controls over financial reporting. The office evaluates the development and operation of these internal controls according to a predetermined scope for evaluation, and makes a report to the president.

(d)Independent auditors

In accordance with the Corporation Law and the Financial Instruments and Exchange Law, we receive annual audits by Ernst & Young ShinNihon LLC.

The following certified public accountants performed the audit of KYORIN Pharmaceutical Co. Ltd.:

(Names of certified public accountants)

Ryo Kayama, designated limited liability partner and engagement partner;

Atsushi Kasuga, designated limited liability partner and engagement partner.

A further 9 certified public accountants, 5 assistant accountants and 7 others assisted with the audit.

The Board of Auditors provides a forum for close, regular exchange of information and opinions with the Internal Audit Office and the accounting auditing firm, thereby enhancing the auditing system.

5. Overview of Personnel, Capital and Trading Relationships between the Company and the Outside Directors and Outside Corporate Auditors

None to report

Independence for the appointment of outside directors and outside cooperate auditor are that they do not apply following: officers or employees of the Group (including the past 10 years) and major shareholders, major business partners, persons who have the Group as their major business partner, persons who receive large amount of money etc. from the Group (In the case of corporations or organizations, officers or employees of them), spouse or relative up to the second degree of kinship (not including past) of these persons, persons who is reasonably considered to be unable to perform his/her duties as an independent outside director or outside statutory auditor because of a risk of a conflict of interest with general shareholders.

Kyorin selects outside directors and outside corporate auditors after reviewing the individuals’ backgrounds and relationship with Kyorin and from a standpoint independent from that of management, on the assumption that sufficient independence is ensured. All outside directors and outside corporate auditors fulfill the requirements of independence criteria stipulated by the Company and have been reported as independent officers to the Tokyo Stoch Exchange.

6. Compensation of Directors and Corporate Auditors

The Kyorin Group’s basic policy is to provide compensation that contributes to the enhancement of Kyorin Group’s corporate value through sustainable and stable growth. Specifically, our compensation consists of two types: basic compensation, which is paid in cash, and stock options, which are paid in shares of the Company.

“Basic compensation” is a remuneration system that defines the appropriate level of benefits for each position based on economic and social conditions and public standards, and also reflects the Company's situation and the performance responsibilities of each officer. In addition, "Stock options" is a remuneration linked to performance, and a system of a stock benefit trust is adopted. For the period of the medium-term management plan, stock benefit points linked to the performance of the Company and each executive are awarded annually, and after the end of the relevant period (in the case of retirement of the executive eligible for the benefit, the amount equivalent to the amount converted at market value for a certain percentage) of our common stock, etc. according to the accumulated points (when the executive eligible for the benefit has retired, the amount equivalent to the market value if certain requirements are met). From the viewpoint of emphasizing the stability and improvement of medium-to long-term performance, the percentage of “Stock options” is set not to be exceeded to “Basic compensation”.

To ensure that outside directors are able to fully exercise their management oversight function, their compensation is limited to “Basic compensation”, which is not linked to annual performance and does not include stock options.

The amount of compensation paid to directors for the year ended March 31, 2024 was 199 million yen for 9 directors (including 33 million yen for three outside directors). There is no amount equivalent to employee salaries for directors.

* Includes three directors who retired on June 23, 2023.

In addition, please refer to the Corporate Governance Report for further details.